Short Term Capital Gains Tax 2025

Short Term Capital Gains Tax 2025. Confused about the federal income tax rates on capital gains and dividends under the tax cuts and jobs act (tcja)? Rates, exemptions, rebates, and conditions for applicability.

Unveiling Form 1099 Reporting ShortTerm Capital Gains, The stcg (short term capital gains). However, to learn the tax implications on the capital gain from these assets,.

The Beginner's Guide to Capital Gains Tax + Infographic Transform, They're taxed like regular income. The proposal requires high net worth households to pay a 25 percent minimum tax rate on an expanded definition of income that includes unrealized capital.

How to Calculate Short Term Capital Gains Tax on Sale of Shares Jordensky, Updated jul 03, 2024, 2:55 pm ist. Learn about short term capital gains tax under section 111a:

How Are Short Term Capital Gains Taxed FinancePart, Explore potential deductions, credits and. Rates, exemptions, rebates, and conditions for applicability.

.png)

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, The federal capital gains tax rate varies based on income level, asset type, and holding period. Learn about short term capital gains tax under section 111a:

Capital Gains and Taxes What You Need to Know in 2023 » K.K. Chartered, Industry and investors have been seeking a simplification of the regime. Learn about short term capital gains tax under section 111a:

2014 Shortterm vs. Longterm U.S. Capital Gains Tax Rates Infogram, The taxability of short term capital gain from these assets varies according to the nature of the effects. Maximize tax benefits on equity.

new capital gains tax plan Lupe Mcintire, This blog provides a comprehensive guide on capital gains taxation, detailing the definition and treatment of capital assets, the differentiation between short. Updated jul 03, 2024, 2:55 pm ist.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, The chancellor has announced that the favourable tax treatment furnished holiday lettings (fhls) currently benefit from will be abolished with effect from 6 april 2025. All stcgs are added to your total income and.

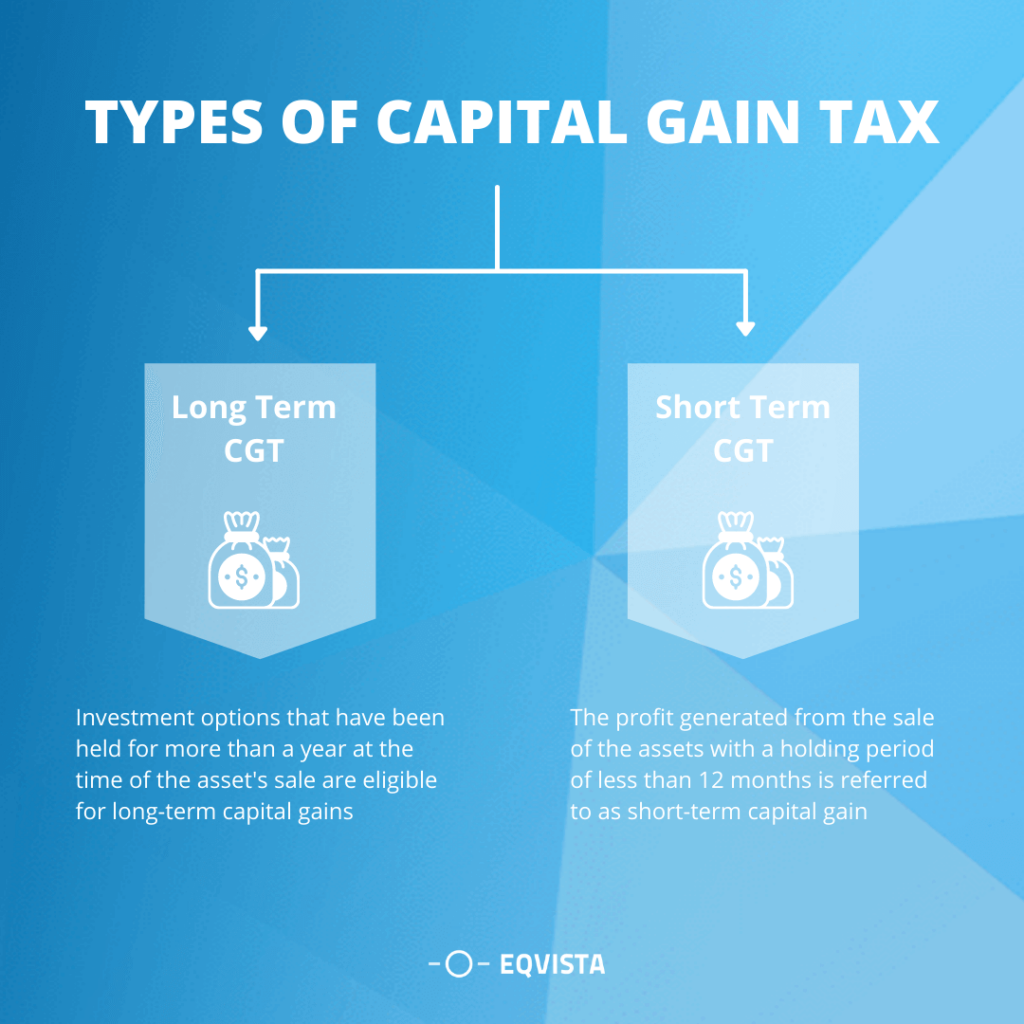

How to calculate capital gain tax on shares in India? Eqvista, The federal capital gains tax rate varies based on income level, asset type, and holding period. Confused about the federal income tax rates on capital gains and dividends under the tax cuts and jobs act (tcja)?

The chancellor has announced that the favourable tax treatment furnished holiday lettings (fhls) currently benefit from will be abolished with effect from 6 april 2025.